According to Morgan Stanley, Which 5 New Restaurant Business Trends Will Outlast COVID-19?

Which of Morgan Stanley's 5 new restaurant trend predictions will survive beyond COVID-19 in Hong Kong?

Contents

Hong Kong's Current Situation

A fourth wave Coronavirus cases in Hong Kong has prompted a new set of strict government-mandated measures on restaurants.

New Hong Kong Government Restaurant Restrictions (Dec 10th - 24th):

1. Hong Kong eateries' dine-in services are to cease from 6pm-4:59am

2. Bars and pubs are not allowed to operate until the 24th of December

3. Restaurants will only be able to seat two people per table (down from four)

4. Restaurants must not exceed 50% capacity

5. Body temperature checks and hand sanitiser must be offered to guests upon arrival

6. Customers must also wear masks before meals, after meals, and when picking up orders

With Hong Kong's F&B market constantly evolving and adapting, which new business trends brought about by COVID-19 will actually have a lasting impact on Hong Kong's F&B industry – even when the virus is gone?

Morgan Stanley’s 5 Restaurant Trends that Could Outlast COVID-19:

1. Digital and Delivery as an Integral Part of Restaurants’ Business Strategies

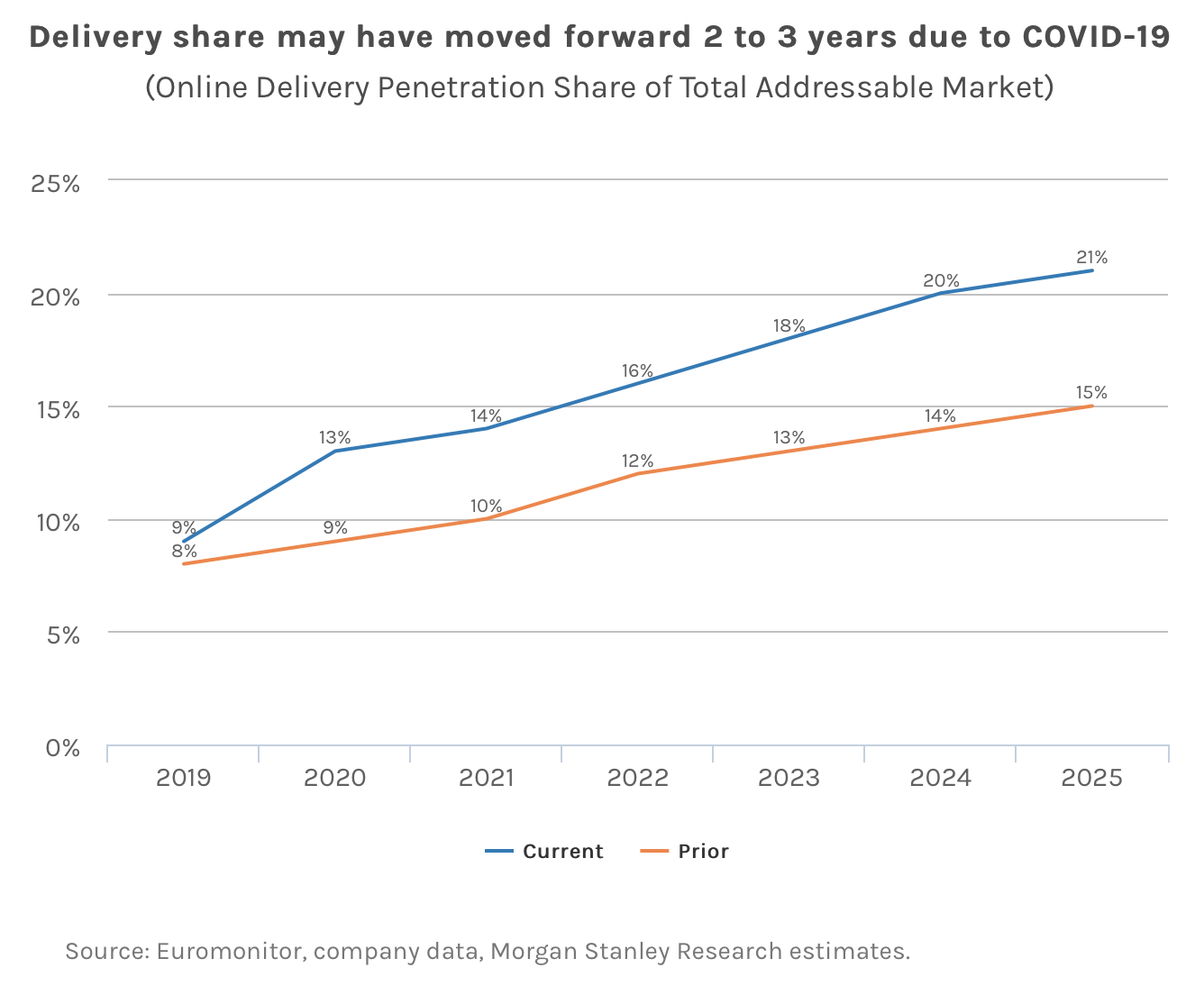

Though Hong Kong restaurants were already gearing up to adopt digital technologies and delivery services as part of their daily business operations, the trajectory for their growth rate was not expected to grow as quickly as it has in 2020. Due to social distancing rules, dine-in bans and general lockdowns around the world, having a digital presence and offering safer delivery options have become necessary tools for F&B businesses to reach customers and survive.

Morgan Stanley has said that “we see total online food delivery—through online delivery platforms and restaurant self-delivery—of $45 billion in 2020, vs. our prior estimate of $41 billion in 2021.”

This trend of “third-party delivery has surged, thanks to increased mobile app orders,” indicating a growing number of restaurants also using BYOD technologies to leverage their online and delivery services.

2. The Impact on Restaurants Due to Work From Home Policies

With the recent trend of businesses letting employees work from home to avoid the spread of the virus, the restaurant industry (especially brick and mortar stores) is being impacted. With fewer office workers going to work, the typical breakfast and lunch time rush may quieten down in the long-run, killing off a huge chunk of business for many restaurant owners who cater specifically to office workers in business districts.

We can already see this trend potentially happening in the US where “working from home has risen to roughly 50% during the crisis vs. 15% before” and this is particularly relevant as it “could it mean, for example, lower demand for weekday breakfast and lunch, as well as coffee away from home, particularly in densely populated areas.” A similar trend could potentially affect business hubs in Hong Kong.

3. A Possible Rise in Restaurant Chains

While larger restaurant chains may have the necessary funds to take a the inevitable hit to sales and profitability that COVID-19 is creating, smaller independent restaurants and chains may not be able to weather the storm. According to Morgan Stanley, estimates based in the US project that approximately “5% to 30%” of independently owned F&B businesses could shut. While the same figures do not necessarily apply in Hong Kong, should the city follow a similar trend, it would free up large chunks of the F&B market for large chains to take control of.

The figures released by Morgan Stanley state that in the US, “assuming 10% to15% of independents close, we estimate this would put about $20 billion to $35 billion in sales up for grabs, mostly in the full-service category. In fast food, using those same assumptions, we estimate that 2% to 4% of industry sales would be freed up.”

However, they also point out that independent restaurants are resilient and have a tendency to bounce back. “The industry enjoys persistent regeneration, in part because restaurant sites preserve significant sunken costs, such as plumbing, high-volume air-conditioning systems and other specialized equipment, making it cost-effective for a new operator to adapt and open for business.”

4. Shrinking Real Estate Footprints

Given the growing digital segment and the acceleration in takeaways and delivery, it may no longer make financial sense for F&B businesses (especially table-service businesses) to invest in large storefronts. In a property market as expensive as Hong Kong, there is certainly the potential for restaurants to opt out of expensive rented real estate. According to Morgan Stanley’s estimates, we may start seeing a trend whereby “full-service restaurants may shrink dining rooms, while enlarging takeout areas.” Not only would this be a more cost-effective option, but it would diversify a business’ revenue streams at the same time.

In addition, many businesses may consider “multibrand location strategies where two or more chain entities share one roof” or ““ghost kitchens”—warehouse-style spaces that house multiple delivery-only restaurants.”

5. Consumer Spending on Groceries to Eat Into Restaurant Profits

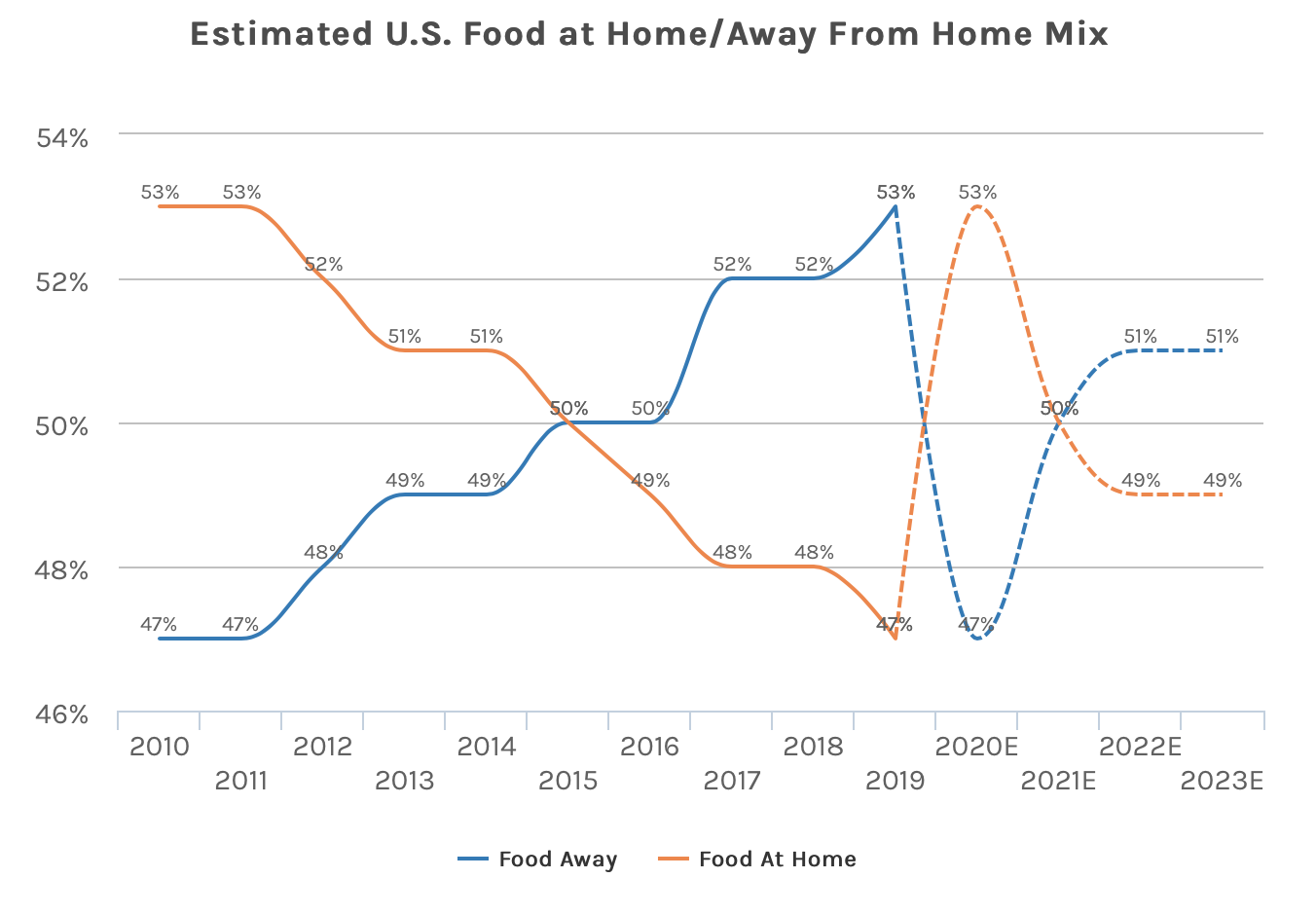

Given the Hong Kong public’s propensity to stay at home during the pandemic, purchases of grocery items have been on the rise. People seem to be developing a strong 'food at home' habit that will likely have long-lasting effects on the restaurant industry, which would prefer the general public to keep their eating out habits. Morgan Stanley’s figures show that in the US, “since about 2015, consumer spending on restaurants (food away from home) has captured around 53% of consumers' wallet share, vs. 47% for food at home. That trend appears to have upended.”

Moving forward, it is predicted that the figures will likely flip for food away from home vs food at home. The reasons for this change include work from home conditions and increased availability of delivery grocery services.